MFSA issues Guidance Notes

MFSA has issued a Guidance note on its expectations of cybersecurity with regards Professional Investor Funds investing in Virtual Currencies and all those entities regulated under the VFA Rulebooks i.e. ICO issues, VFA Agents and VFA Service Providers. For more information kindly click on the below link:

https://www.emcs.com.mt/mfsa-issues-guidance-note-on-cyber-security/

MFSA & the FIAU have jointly also issued a Guidance note to Credit Institutions, Payment Institutions and EMI institutions opening accounts for those persons operating within the financial services sector and using artificial intelligence, distributed ledger technology, the internet of things and cloud technologies for the development of a financial product or provision of a financial service. Click the below link for more details:

https://www.mfsa.com.mt/wp-content/uploads/2019/06/20190618_Guidance_OpeningAccountsForFinTechs.pdf

Please contact Silvan Mifsud on silvan.mifsud@emcs.com.mt for more details about these Guidance Notes and with regards any information related to Fintech regulation.

Avoidance of Damage to Third Party Property Regulation

Following the recent collapse of private properties which were adjacent to a construction site and the subsequent temporary suspension of all permits related to excavation works, government has issued a legal notice on the 25th June, 2019 with new regulations related to the Avoidance of Damage to Third Party Regulation. The full new regulations can be read by clicking on the below link:

http://justiceservices.gov.mt/DownloadDocument.aspx?app=lp&itemid=29637&l=1

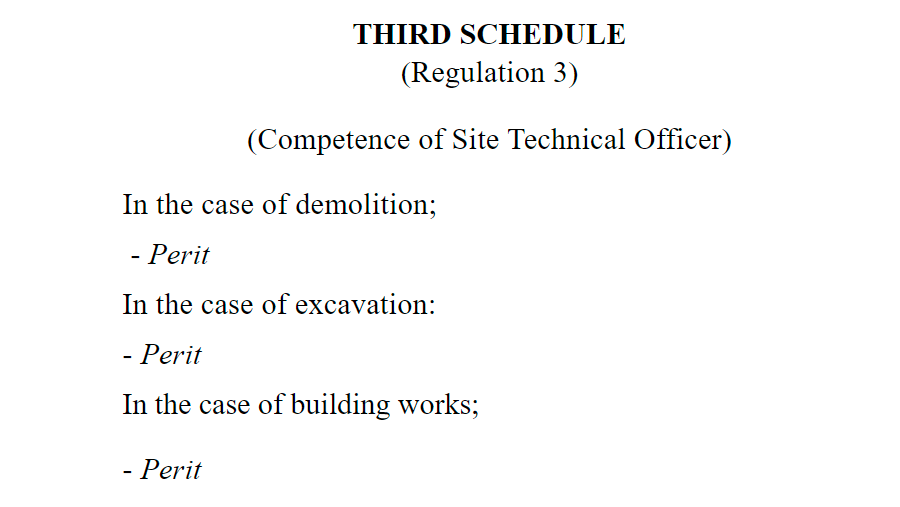

The most controversial aspect of these regulations is that the Site Technical Officer who is to be “responsible for the enforcement of the method statement covering the works which the contractor who nominates him is responsible for and present on site whenever decisions are being taken that influence the risk of damage to third party property or injury to persons that may be caused by the works” is to have the competence of being a warranted architect as shown in the Third Schedule below:

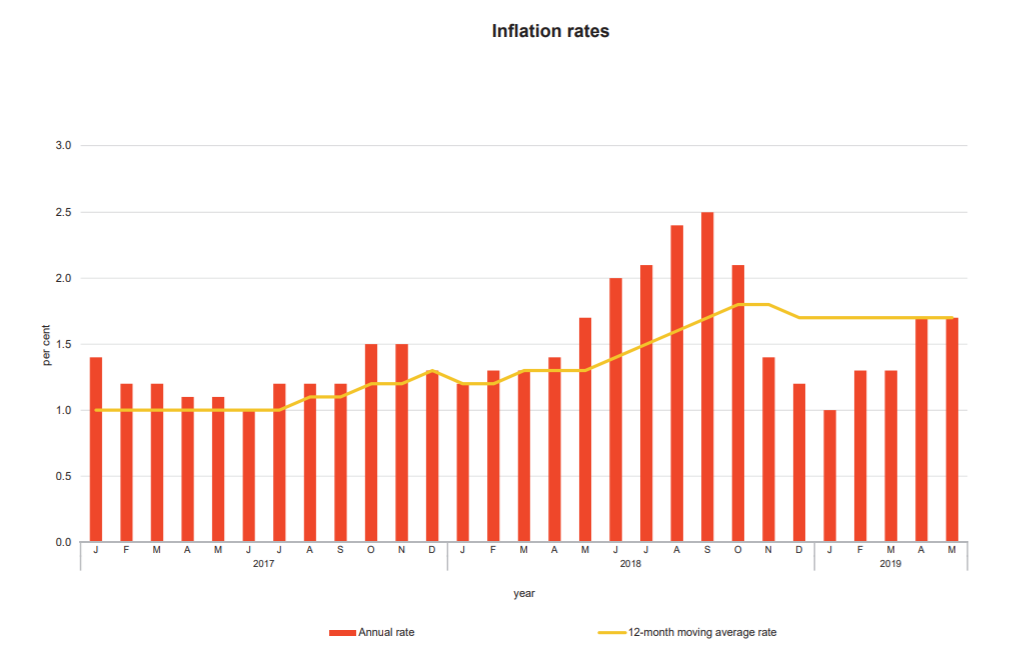

Inflation remains constant

In May 2019, the annual rate of inflation as measured by the Harmonised Index of Consumer Prices (HICP) remained at a constant rate of 1.7%. The largest upward impact on annual inflation was measured in the Food and Non-Alcoholic Beverages Index, while the largest downward impact was recorded in the Education Index

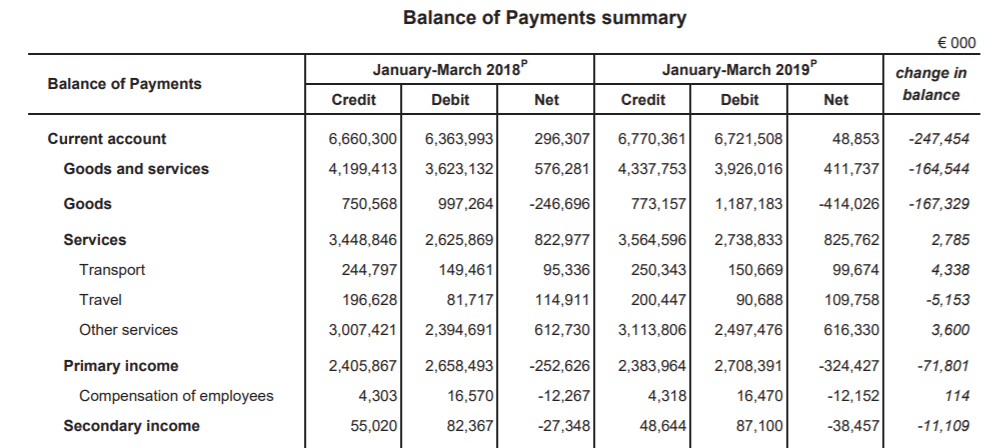

Current account surplus in Q1 2019

Provisional figures for Malta’s external transactions show that during January-March 2019, the current account balance recorded a surplus of €48.9 million as compared to a surplus of €296.3 million in the comparable quarter of 2018. This means a significant reduction in the surplus figure of €247.4 million over the same period of last year. The surplus registered was primarily the result of a positive net balance of the services account of €825.8 million marked by improvements in the net balances of the other services, travel and transport accounts. This was partially outweighed by negative net balances in the goods account (€414.0 million), primary income account (€324.4 million) and secondary income account (€38.5 million).

Malta’s Latest Economic & Financial related News

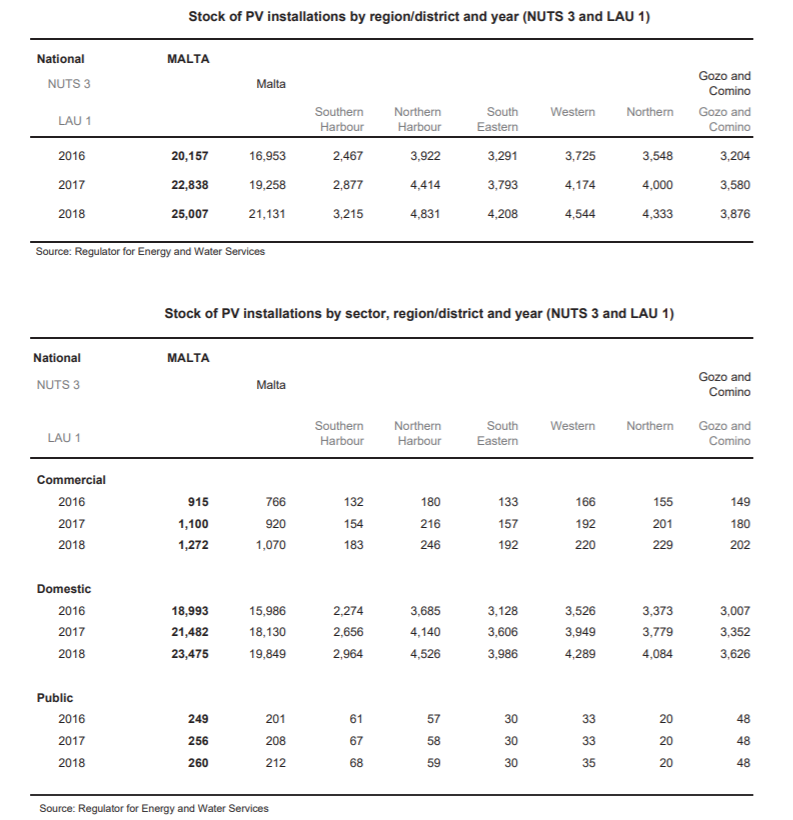

The stock of Renewable Energy Photovoltaic installations by the end of 2018 amounted to 25,007 of which 84.5 % were installed in the region of Malta and 15.5% were in the Gozo and Comino region. The domestic sector accounted for 93.9% of the total stock of PV installations. Most increases in new PV installations in 2018 resulted from the domestic sector, with the Northern Harbour district having the highest stock of PV installations.

TOP QUOTE