Malta’s Population: High Growth in short duration stays

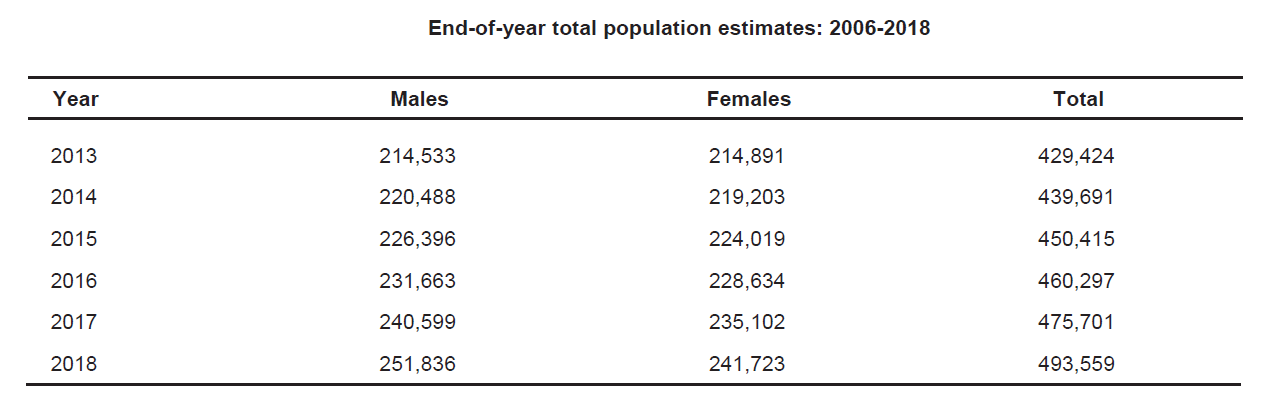

The estimated total population of Malta and Gozo at the end of 2018 stood at 493,559, up by 3.8% when compared to 2017.

As can be seen from the table above, over a 5-year period (i.e. end 2013 to end 2018), Malta’s population grew by 13%, which means an average growth of 2.6% annually.

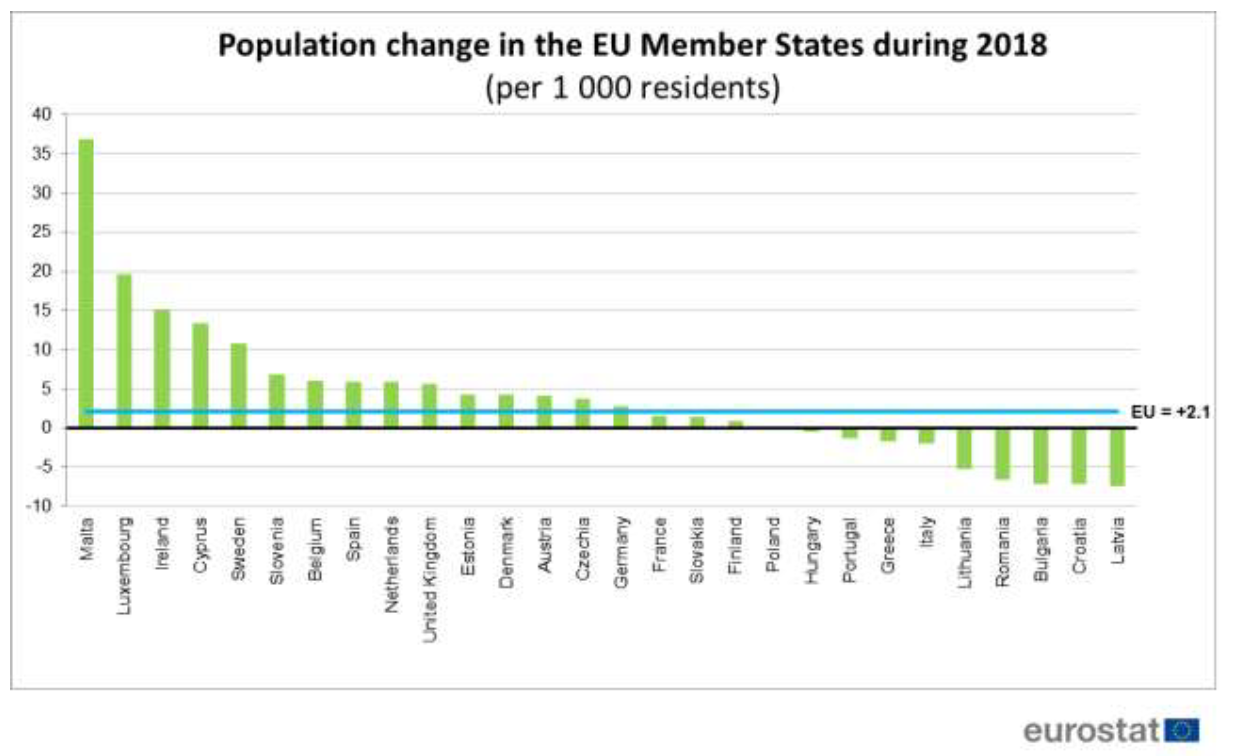

Compared to other EU member states, Malta registered the highest growth in population per 1000 residents, with a population increase of almost 37 per 1000 residents.

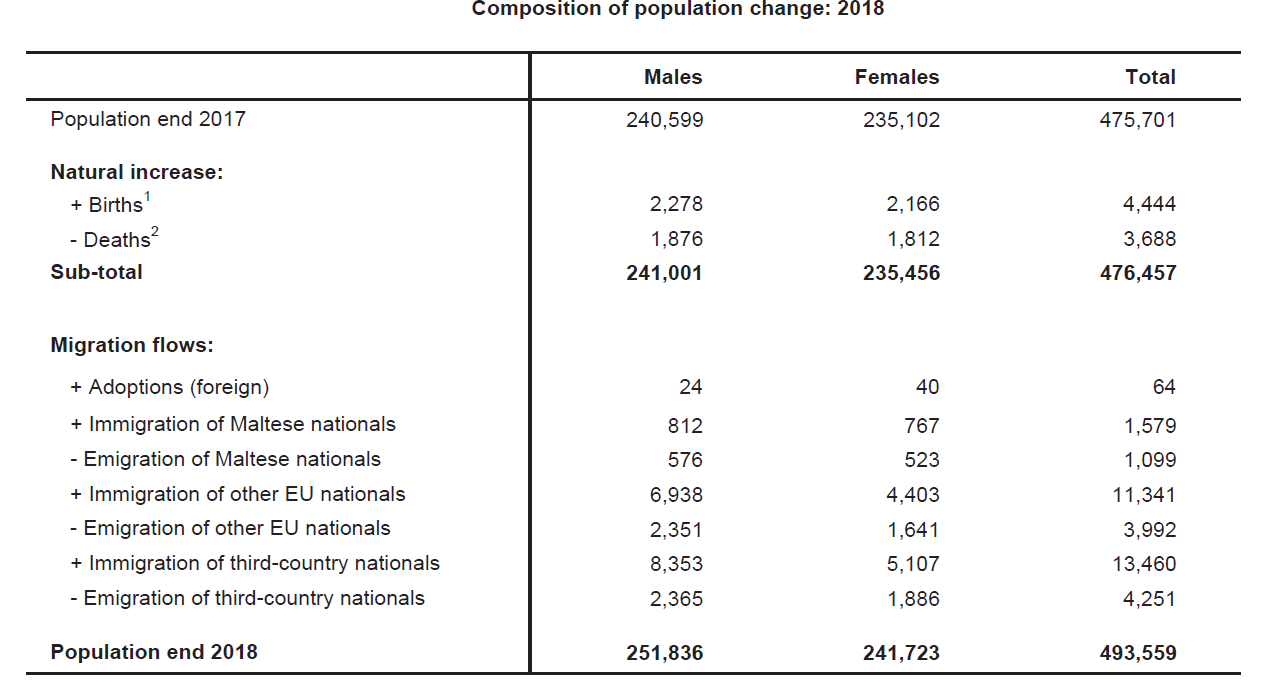

As can be seen from the table below, the growth was fuelled by immigration. It is interesting to note that in 2018 Malta registered a higher amount of immigrants from 3rd Country Nationals than from EU nationals.

The above ties in with the latest Quarterly Review of the Central Bank of Malta which included an analysis with regards to the “The length of stay of foreign workers in Malta”

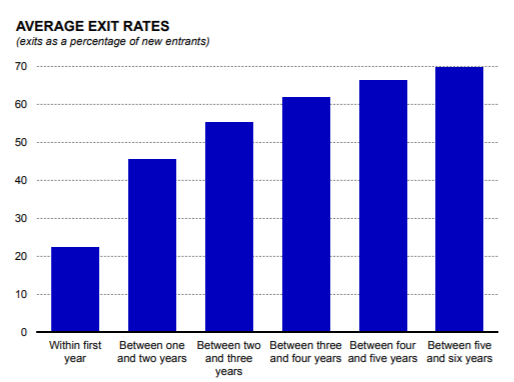

The analysis by the CBM concluded that on average 25% of foreign workers exited the labour market within the same year they entered the labour market, whereas 45% of foreign workers exited after a period of between one and two years. It also emerges that only 30% of non-Maltese workers remain in the Maltese labour market for more than six years after their first engagement.

It is interesting to note that Malta’s out-migration rate is more pronounced than that observed in other advanced economies. According to the Organisation for Economic Co-operation and Development (OECD), between 20% and 50% of immigrants either return to their home country or move to third countries five years after their arrival. By contrast, around 50% of foreign workers in Malta exit the Maltese labour market within two years of their arrival.

The Central Bank Quarterly Review Analysis draws interesting conclusions on the effect of such high turnover in foreign workers in Malta on the economy both on a micro and macro level. On the negative side, the process of constantly selecting and hiring workers, as a result of the high level of labour turnover, puts significant pressure on the human resource departments of firms. There are also broader implications for the Maltese economy such as the quantity and nature of housing that is demanded. If a larger proportion of the workforce is transient, the demand for smaller properties available for rent is likely to increase. If most workers are not intending to build a career in the country, this has implications on their relative consumption of goods and services, their demand for saving products and also for the ability of firms to motivate them. In an environment where staff tends to leave after a year or two, the incentives for employers to train and provide a career to non-natives employees inevitably declines. The presence of large flows of foreign workers also has implications for certain sectors where traditionally demand evolved rather slowly, notably public transport, education and the rental market. Enhancing these sectors, both in terms of supply and in terms of their responsiveness to demand, could play a role in lengthening the stay of foreign workers in Malta.

This we believe is an area which requires much more in-depth analysis and study. Such analysis should focus on the carrying capacity of Malta with regards its infrastructural resources. What must be avoided is a situation whereby a future economic slowdown is accentuated through the sudden increase in outflows of foreign workers leaving Malta.

First time in 11 years -Moody upgrades Malta’s credit rating

Credit rating agency Moody’s has upgraded Malta’s rating from A3 to A2 while moderating its outlook for the country from ‘positive’ to ‘stable’. The upgrade is Malta's first in 11 years.

Moody's said the changes were based on the “continued improvement of Malta's fiscal strength, on the back of a prudent fiscal stance and an enhanced fiscal policy framework” and Malta's strong medium-term growth prospects. “The stable outlook on the rating reflects our expectation that government debt levels will continue to decline in coming years, although at a gradually slower pace as we also expect the growth rate of the Maltese economy to decelerate from the exceptionally high rates registered in recent years,” Moody’s said. The agency also noted the improved financial health of previously troubled entities such as Enemalta and Air Malta, both of which had now returned to profitability.

Moody’s said the change in outlook from a “positive” to “stable” outlook was based on the expectation that the current rate of growth - 7.2% of GDP from 2013 to 2018 - was likely to slow down “as the economy is running up against capacity constraints, and the pace of expansion will slow for the rapidly expanding sectors that have been driving growth in recent years”.

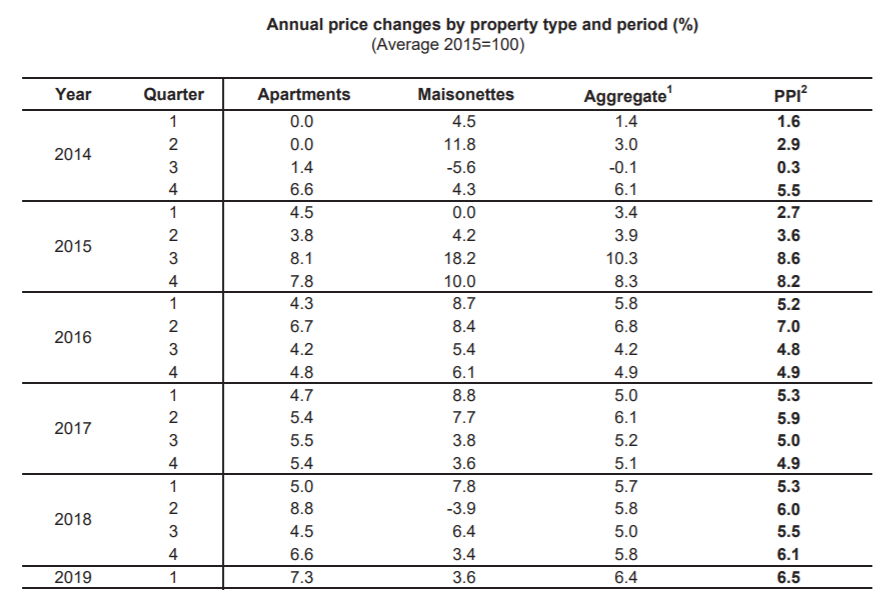

Property: Prices keep rising at a faster pace

During the first quarter of 2019, the Property Price Index (PPI) increased by 6.5 % when compared to the corresponding quarter of the previous year. Provisional figures indicate that the main driver of the increase was the Apartments price index, although the Maisonettes price index also went up. In the first quarter of 2018, the PPI registered a rise of 5.3% when compared to the same quarter of the preceding year.

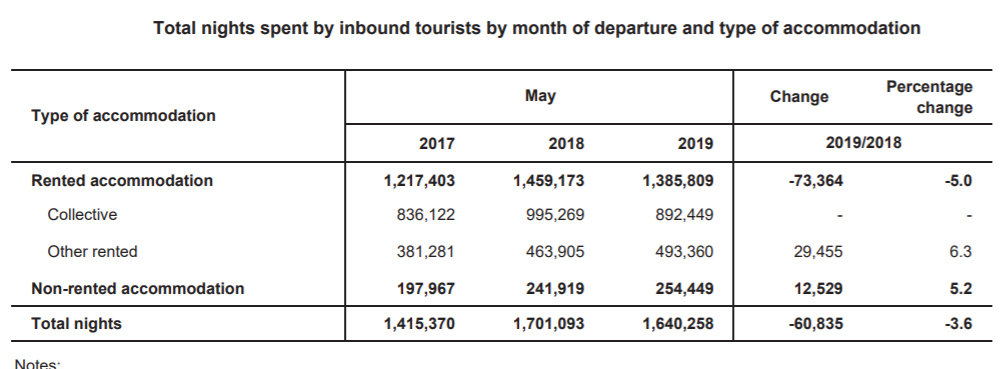

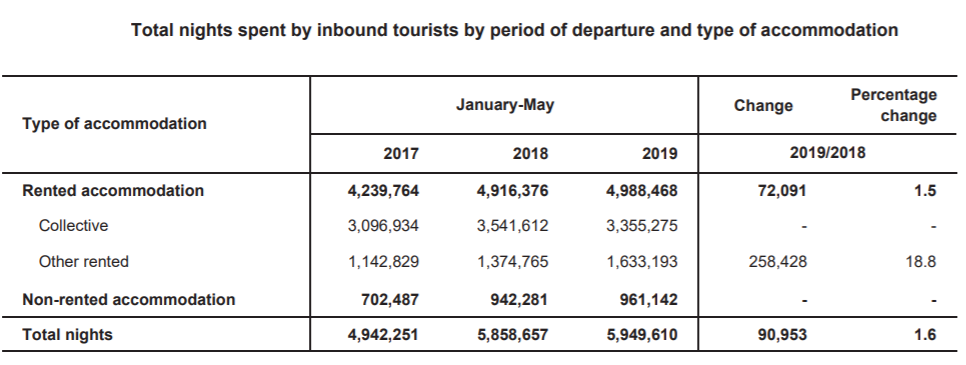

Inbound Tourism: registers a decrease in number of nights

Inbound tourist for the first five months of 2019 amounted to 929,979, an increase of 2.8% over the same period in 2018. Total nights spent by inbound tourists went up by 1.6% surpassing 5.9 million nights. Total tourism expenditure was estimated at €648.1 million, 3.2% higher than that recorded for 2018. Total expenditure per capita stood at €697, an increase of 0.4% when compared to 2018.

It is however interesting to note that when taking the month of May 2019, the number of total nights spent by inbound tourists has decreased by 3.6% when compared to the same month in 2018.

It is also interesting to note that all the decrease is coming from Hotel accommodation sector and that the non-Hotel accommodation continued to experience an increase in May 2019.

Having a look at this aspect over the period of January – May, once sees that as the overall number of nights increased by 1.6% in 2019 over 2018, the increase was only coming from an increase in the number of nights from non-Hotel accommodation, as the number of nights in Hotel accommodation has decreased.

Public Finances: Small deficit in Q1 2019

In the first quarter of 2019, the General Government recorded a deficit of €16.5 million. During the period January to March 2019, total revenue stood at €1,130.8 million, an increase of €89.3 million when compared to the corresponding quarter last year. The key contributors were Current taxes on income and wealth and Capital transfers receivable with an increase of €90.6 million and €17.9 million respectively.

Total expenditure in the first quarter amounted to €1,147.3 million, an increase of €99.9 million over the corresponding quarter of 2018. Increases were recorded in almost all categories, mainly in Intermediate consumption (€47.5 million), Gross capital formation (€36.6 million), Current transfers payable (€34.0 million), Compensation of employees (€19.0 million), Subsidies payable (€3.8 million) and Social benefits and social transfers in kind (€0.4 million).

Malta’s Latest Economic & Financial related News

MFSA launched a consultation document named “Security Token Offering - MFSA Capital Markets Strategy”. In this consultation document MFSA outlines its attempt to define STOs making a distinction between “Traditional STOs” and “Other STOs”, with its focus so far limited to just “Traditional STOs”. For more detail kindly click on the below link: