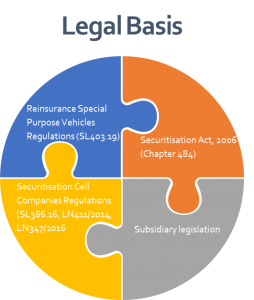

An independent EU member state in the middle of the Mediterranean Sea – Malta –offers an advanced legal basis for a set-up of securitization structures. A set of laws and established business practices in the course of past decades, together with its cost-efficiency, makes this jurisdiction attractive again for post-COVID financial planning.

Maltese securitisation vehicles are flexible and used to structure various forms of securitisation transactions, for instance: trade receivables, lease/charter payments for aircraft and ships, synthetic risk transfer securitisation, insurance risk, income/royalty streams from intellectual property assets and synthetic risk transfer securitisation structures.

The laws in Malta offer the following key features of protection and rights: Bankruptcy Remoteness, Limited Recourse, True Sale, Non-Petition Clauses, Priority Claim Over Assets.

Under the Maltese legislation, a securitisation vehicle may be:

- a company (including an investment company)

- a commercial partnership;

- a trust created by a written instrument;

- Or any other legal structure which the competent authority may permit, established the laws of Malta or those of a jurisdiction recognised by the competent authority.

Here, it is worth to mention a special type of Securitization vehicles - Securitisation Cell Companies (“SCC”), that may create one or more cells. Firstly, such SCC is a single legal person and the creation, by a SCC, of a cell does not create, in respect of that cell, a legal person that is separate from the securitisation cell company. Secondly, the assets and liabilities of each cell comprised in a SCC are treated as a separate patrimony from the assets and liabilities of each other cell of the SCC.

Malta, being an independent member state of the European Union, offers attractive rules on the tax treatment of securitisation vehicles, which results in tax neutrality in respect of the securitisation transactions. The said tax neutrality can be achieved through a combination of two laws:

- Income Tax Act (the general provisions on deductibility of expenses under the); and

- Securitisation Transactions (Deductions) Rules

It is worth noting that most Securitisation vehicles are exempt from licensing or other authorisation requirements. Instead, a notification to the Malta Financial Services Authority (“MFSA”) would suffice. The only exception to this rule is where such entity issues financial instruments to the public on a continuous basis, in which case an application for authorisation from MFSA is required. The law is particularly clear on transactions with a managed or dynamic portfolio of assets: the Securitization Act specifies that in these cases, the Maltese securitisation vehicles are not regarded as collective investment schemes (“CISs”) and Alternative Investment Funds (AIFs) and therefore are exempt from the regulatory regime applicable to the latter.

Significantly, Malta is a recognised jurisdiction of choice for the yachting and aviation industries for various reasons. The negative impact of Covid-19 on these industries will require refinancing and securitisation is an ideal solution. Malta can create a niche offering for the set-up of securitization structures, minimising costs that may arise through cross border structuring, and tapping on its robust legal framework, especially in the context of Maltese statutory mortgage.

Written by Geraldine Schembri, Partner, EMCS and published on mondaq - https://www.mondaq.com/securitization-structured-finance/935072/securitization-in-malta-advanced-european-solution