Macroeconomic Overview

- Malta’s economy is expected to grow by 4.1% in real terms by end 2023.

- Inflation in Malta for 2023 is expected to be 5.7%

- In 2023, Malta’s economy is expected to grow by 4.2% (real terms). Domestic Demand is expected to remain strong.

- Inflation in Malta next year is expected to be lower, than in 2023, at 3.7% but higher than the expected Euro area average of 2.8%.

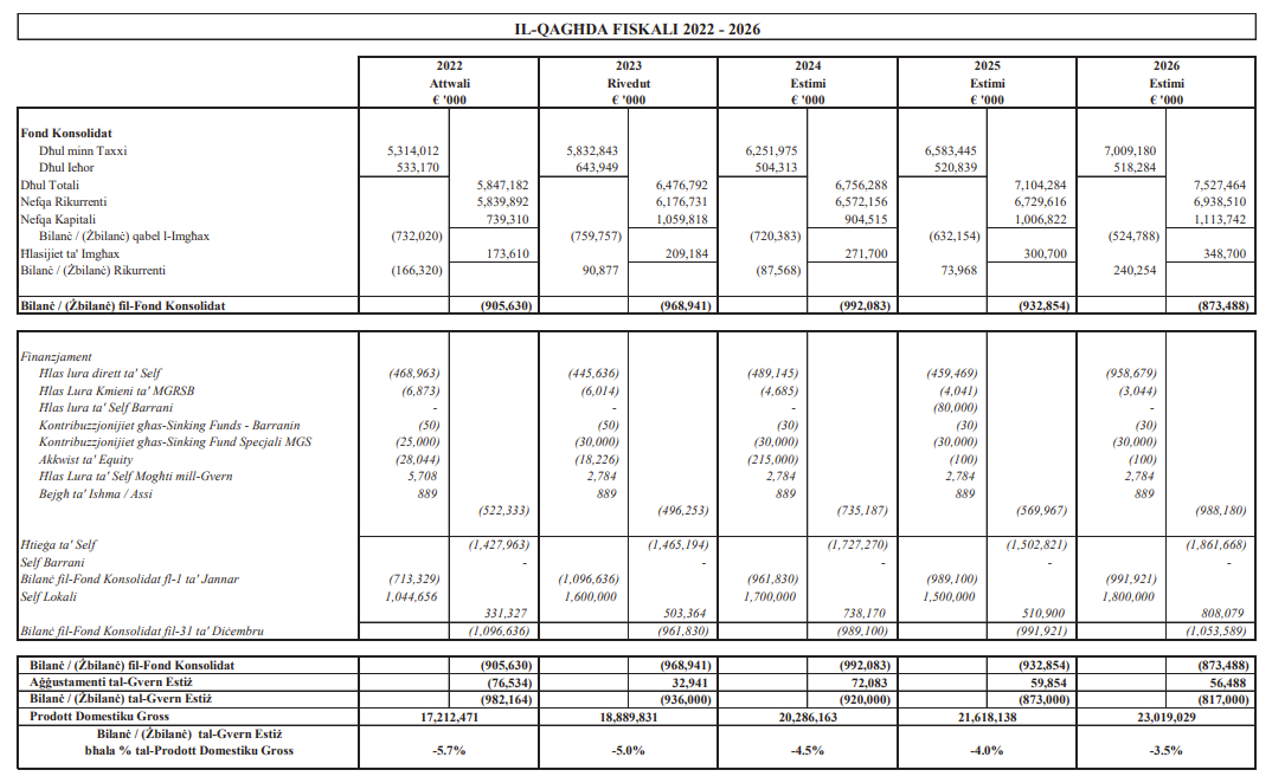

Public Finances

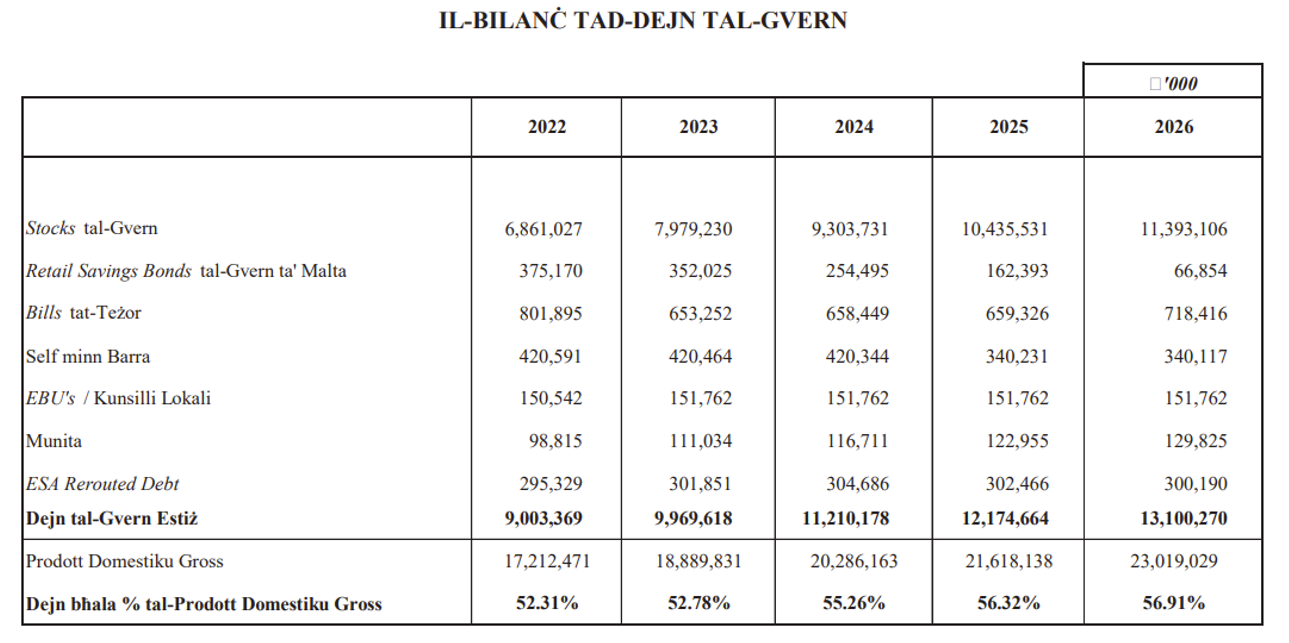

The Public finances are expected to keep having substantial annual deficits for the foreseeable future, with the annual deficit to remain within the range of around 800 million to 900 million EUR per year. As shown below, for the increase in government debt to remain sustainable the economy is forecasted to grow to the level of EUR 23 billion by 2026, with government debt increasing from under EUR 10 billion by end 2023 to just over EUR 13 billion in 2026.

Overview of Leading Social Measures

- Every pensioner will have seen their pension increased by EUR 15 per week or EUR 780 per year.

- A tax exemption on widow’s pension shall be granted to beneficiaries under the age of 61. Such beneficiaries shall also benefit from a gradual increase in the pension up to the amount that would have been received by the spouse.

- Pensioners who opt to postpone receiving their pension in order to continue working will benefit from an additional increase in their pension income equivalent to 6.5% for a 1 year postponement, 13.5% for a 2 year postponement, 21% for a 3 year postponement and 29% for a 4 year postponement.

- Cost of Living Adjustment (COLA) for 2024 shall amount to €12.81 per week

- With effect from January 2024, the minimum wage is to increase from €192.73 per week to €213.54 per week.

- Government discussions with social partners and stakeholders are ongoing, in order to promote more employees signing up for Private Pension Schemes

- 95,000 families will benefit from the additional COLA which is being extended to reach more individuals. This benefit will vary between EUR 100 – EUR 1,500 per year, per family, depending on the family incomes and number of family members.

- Children Allowance will increase by EUR 250 per child. This will cost EUR 15.5 million.

- A special allowance shall be granted when children remain in full time education following obligatory education of €500 per annum for the next years, if they remain living with their families

- The benefit for every newborn or new adoption is being increased from EUR 400 to EUR 500 for the first born and from EUR 400 to EUR 1,000 for the second born.

- Benefit for the elderly of 80 years and over, who live at home or in a private home will increase by EUR 50 to EUR 450 per year, while those between 75 years to 80 years will continue receiving the EUR 300 per year.

- The subsidy “Carer at home” for the elderly will be increased by EUR 1,000 to EUR 8,000 per year.

- Increase in unemployment benefit to hit 60% of last wage for the first six weeks and then tapers to 55% for the next 10 weeks and 50% for another 10 weeks.

- Increase in tax credits from EUR 200 to EUR 500 per year for parents of disabled children who attend therapy other than that offered by Government

- Persons undergoing a rehabilitation programme will see an increase in the assistance they receive from EUR 10 per week to EUR 50 per week.

- Donations by entities to registered Voluntary organisations who operate directly in social, environment or animal welfare shall be allowed as a tax credit up to a maximum of €500

- Extension to the exemption on tax and duty on the first €200,000 on the sale and acquisition of property registered under various government schemes, as well as an extension to the first-time buyers’ scheme

Investing in Skills

- The general personal tax refund scheme will remain as last year, with refunds between EUR 60 to EUR 140 per person to be paid, in accordance to the level of income, as long as such income does not exceed EUR 60,000

- Pensioners who keep on working, will see a greater chunk of their pension not considered as taxable income. This chunk has now been increased to 60%.

- Student stipends will continue increasing pro-rata with the cost of living, resulting in a EUR 64 per year.

- Get Qualified Tax credits for those studying at Masters or Doctorate level will continue.

- Whilst Malta has economic sectors which need foreign workers, government will implement systems whereby only foreign workers that are truly needed will be allowed to come to work in Malta, whilst improving the skills of such foreign workers.

- Revision of the Highly Qualified Persons Rules is being discussed.

- Alignment of the merchant shipping act and companies act. A reduced obligation for audit requirement for tax purposes

Future Economy

- Venture Capital Fund has been introduced and next year a new Seed investment Scheme will be introduced. This scheme will offer tax credits to Maltese companies that invest in start-ups.

- Skills Development Schemes, Rent Subsidy Schemes, Smart & Sustainable Scheme will be continued

- ESG consultancy schemes for SME, recently launched will continue into 2024

- Malta as a centre for microchips, as an approved EU member state to fall under the IPCEI, through ST Microelectronics

- International Taxation- The EU Directive that implements a Minimum global tax of 15% and which is applicable to Multinational Entities (MNEs), will come into effect in 2024. However, the Directive allows Member States to postpone the implementation into their domestic rules for up to a maximum period of 6 years in cases where Member States do not have a significant number of MNEs. Malta will delay the implementation and won’t introduce any top-up tax rules during 2024 which would bring the tax up to 15% in order to follow global developments and be prepared to act accordingly.

The current Maltese tax system will also not be reformed, and the existing full imputation system will continue to apply.

Efforts will be made to put measures and incentives in place which conform with EU and OECD rules to limit any increased tax suffered under the newly implemented rules at a global level.

- Family Businesses: Apart from the extension to the reduction of stamp duty upon inter-vivos transfers from 5% to 1.5%, this budget will see that Family Businesses, registered with the Family Business Office will have a greater capping for tax credits related with investments. Family Businesses will also be supported with tax incentives when they go international, digitalise or innovate.

- The current reduced tax rate of 7.5% applicable to professional players and athletes, as well as coaches shall be extended to other people employed within the sporting sector

- The Government aims to launch a consultation concerning tax incentives that are tailored to Real Estate Investment Trusts (REITs).

- The Government is to explore the introduction of an ad hoc tax depreciation framework and initiatives to attract banks and financiers in support of the aircraft leasing sector.

- The Malta Financial Services Authority (MFSA) is in the process of implementing regulatory changes, including those relating to Notified Professional Funds and Limited Partnerships.

- Government has committed to focusing on the implementation of the national e-sports strategy and shall also continue strengthening the quality of education and training for the development of digital games.

- The Malta Gaming Authority shall focus on strengthening the regulatory framework to ensure that it remains relevant to meet the challenges of the gaming industry.

- During 2024, Government aims to design Malta’s vision for the maritime industry for the next 20 years as well as implement a new aviation policy together with the Air Navigation Act.

- A new consultation will be held to discuss new proposals for tax incentives for sustainable investments, like Green bonds.

- The Business Enhance, EU funding, will continue next year. These schemes will give SMEs around EUR 40 million in cash grants. Such Schemes will focus on Start-ups, the growth of such SMEs, the diversification of such SMEs and SMEs that invest to reach new markets.

- In the coming months a new scheme from Lands Department, similar to the 2015 Valletta Shop Scheme, will be launched for the whole national territory.

- Expected changes to the merchant shipping act to be done next year as well as the introduction and implementation of the superyacht

Environment

- A Climate Action Authority will be set up with the aim of spearheading Malta’s commitment to reach climate neutrality by 2050.

- Government plans to initiate work on a strategy to introduce the use of hydrogen locally.

- Government plans to launch a consultation for the development of fiscal incentives for companies and investors to make sustainable investments.

- Renewable energy schemes on solar panels, batteries for energy conservation and heat pump water heaters, will be continued.

- There will be an allocation for 40kWp and 1MWp to reach 10MWp, which will mean an assistance of EUR 44.8 million over 20 years. If this allocation is taken all this will mean an energy generation from renewables for the need of around 3,650 households.

- The scheme for home reverse osmosis systems will continue in 2024.

- The schemes with regards the purchase of new electric cars and motorcycles will be continued.

- A new scheme will be introduced to incentivise the purchase of personal e-kick scooters.

- Electric vehicles, as well as plug-in hybrid vehicles, with an electric range of not less than 50km will remain exempt from the payment of registration tax in 2024, as well as from the annual circulation tax for five years from the date of registration.

- With regards traffic, a study will be undertaken next year on the possibility of a public-private partnership, for parking zones.